Unlocking Financial Assurance: The Significance of Standby Letters of Credit with Prominence Bank

In the dynamic landscape of international trade and commerce, ensuring trust and security in transactions is paramount. Standby Letters of Credit (SBLCs) stand as stalwart instruments in providing financial assurance to parties engaged in diverse business endeavors. Prominence Bank, a beacon of reliability and innovation in banking, recognizes the indispensable role of SBLCs in facilitating seamless trade transactions and mitigating risk for its clients.

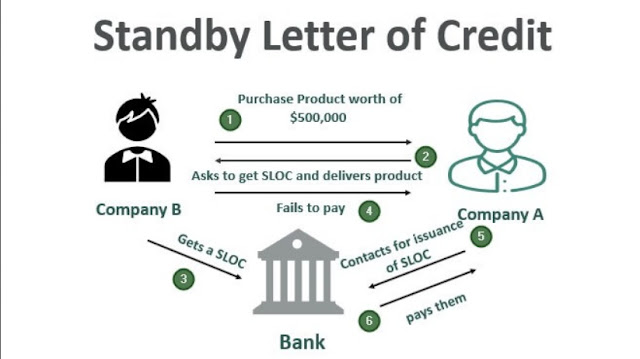

At the core of Prominence Bank's commitment to fostering global trade is its robust suite of financial solutions, among which SBLCs feature prominently. An SBLC, issued by Prominence Bank on behalf of its clients, serves as a guarantee of payment in the event of non-performance or default. Whether facilitating international trade agreements, construction projects, or financial transactions, an SBLC instills confidence and credibility, fostering mutually beneficial relationships between transacting parties.

The versatility of SBLCs renders them indispensable across a spectrum of industries and scenarios. In international trade, where parties may be unfamiliar with each other or operating in unfamiliar regulatory environments, an SBLC provides reassurance by guaranteeing payment or performance obligations. This assurance minimizes the risk of non-payment or breach of contract, enabling businesses to engage in cross-border transactions with confidence.

Furthermore, SBLCs play a pivotal role in project financing and development, particularly in the construction sector. Prominence Bank's SBLCs offer contractors and developers the assurance of timely payment and performance, thereby facilitating the execution of large-scale projects with multiple stakeholders. By mitigating the risk of default, SBLCs foster trust and collaboration among project participants, ensuring the timely completion of infrastructure and development initiatives.

In addition to their role in facilitating trade and construction projects, SBLCs serve as invaluable financial tools in the realm of banking and finance. Prominence Bank's SBLCs provide security for loans, investments, and other financial transactions, offering lenders and investors the confidence to extend credit or capital. This assurance enables businesses to access the funding needed for expansion, innovation, and strategic initiatives, driving economic growth and prosperity.

In conclusion, Standby Letters of Credit are indispensable instruments in the modern business landscape, offering assurance, security, and trust in diverse transactions. Prominence Bank, with its unwavering commitment to excellence and reliability, stands as a trusted partner in providing SBLCs tailored to the unique needs of its clients. Through the issuance of SBLCs, Prominence Bank empowers businesses to navigate the complexities of global commerce with confidence and certainty, unlocking new opportunities for growth and prosperity.

At the core of Prominence Bank's commitment to fostering global trade is its robust suite of financial solutions, among which SBLCs feature prominently. An SBLC, issued by Prominence Bank on behalf of its clients, serves as a guarantee of payment in the event of non-performance or default. Whether facilitating international trade agreements, construction projects, or financial transactions, an SBLC instills confidence and credibility, fostering mutually beneficial relationships between transacting parties.

The versatility of SBLCs renders them indispensable across a spectrum of industries and scenarios. In international trade, where parties may be unfamiliar with each other or operating in unfamiliar regulatory environments, an SBLC provides reassurance by guaranteeing payment or performance obligations. This assurance minimizes the risk of non-payment or breach of contract, enabling businesses to engage in cross-border transactions with confidence.

Furthermore, SBLCs play a pivotal role in project financing and development, particularly in the construction sector. Prominence Bank's SBLCs offer contractors and developers the assurance of timely payment and performance, thereby facilitating the execution of large-scale projects with multiple stakeholders. By mitigating the risk of default, SBLCs foster trust and collaboration among project participants, ensuring the timely completion of infrastructure and development initiatives.

In addition to their role in facilitating trade and construction projects, SBLCs serve as invaluable financial tools in the realm of banking and finance. Prominence Bank's SBLCs provide security for loans, investments, and other financial transactions, offering lenders and investors the confidence to extend credit or capital. This assurance enables businesses to access the funding needed for expansion, innovation, and strategic initiatives, driving economic growth and prosperity.

In conclusion, Standby Letters of Credit are indispensable instruments in the modern business landscape, offering assurance, security, and trust in diverse transactions. Prominence Bank, with its unwavering commitment to excellence and reliability, stands as a trusted partner in providing SBLCs tailored to the unique needs of its clients. Through the issuance of SBLCs, Prominence Bank empowers businesses to navigate the complexities of global commerce with confidence and certainty, unlocking new opportunities for growth and prosperity.

.jpg)

Comments

Post a Comment