Unlocking Financial Assurance: The Significance of Standby Letters of Credit with Prominence Bank

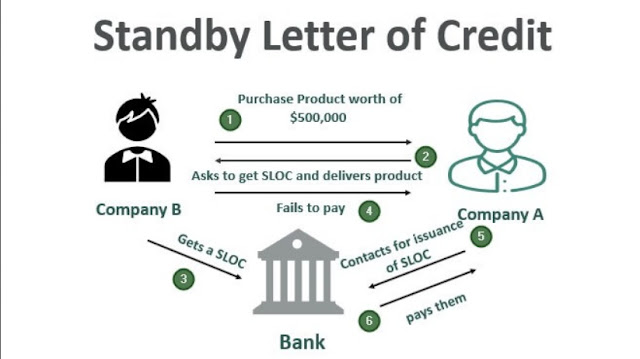

In the dynamic landscape of international trade and commerce, ensuring trust and security in transactions is paramount. Standby Letters of Credit (SBLCs) stand as stalwart instruments in providing financial assurance to parties engaged in diverse business endeavors. Prominence Bank, a beacon of reliability and innovation in banking, recognizes the indispensable role of SBLCs in facilitating seamless trade transactions and mitigating risk for its clients. At the core of Prominence Bank's commitment to fostering global trade is its robust suite of financial solutions, among which SBLCs feature prominently. An SBLC, issued by Prominence Bank on behalf of its clients, serves as a guarantee of payment in the event of non-performance or default. Whether facilitating international trade agreements, construction projects, or financial transactions, an SBLC instills confidence and credibility, fostering mutually beneficial relationships between transacting parties. The versatility of SBLCs