Secure Transactions - Standby Letter of Credit Services with Prominence Bank

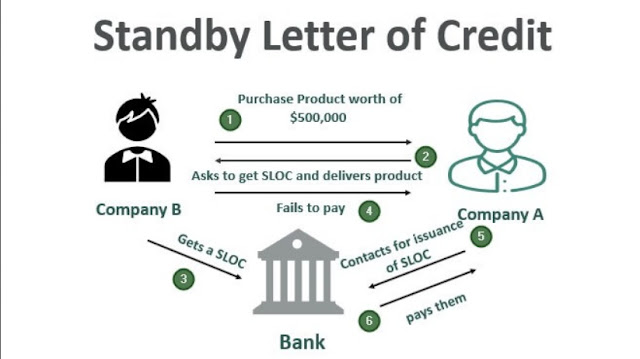

In today's globalized business environment, navigating international trade can be complex. Unfamiliarity with a potential business partner, concerns about payment fulfillment, and the ever-present risk of default can all hinder the smooth flow of transactions. To mitigate these risks and promote trust, businesses increasingly rely on Standby Letters of Credit (SBLCs). What is a Standby Letter of Credit? A Standby Letter of Credit is a financial instrument issued by a bank, like Prominence Bank, on behalf of an applicant (usually the buyer). It acts as a guarantee of payment to the beneficiary (usually the seller) in the event that the applicant fails to fulfill their contractual obligations. Essentially, the SBLC serves as a safety net, assuring the seller that they will receive payment even if the buyer defaults. How Does a Standby Letter of Credit Work? The process typically involves the following steps: 1. Application: The buyer applies to Prominence Bank for an SBLC issuanc

%20(3).jpg)