Structured finance products is a market-linked investment

Structured finance products are the investment which in turn involves different parties to make a perfect understanding to start with. The parties involve bank, beneficiary, and the applicant.

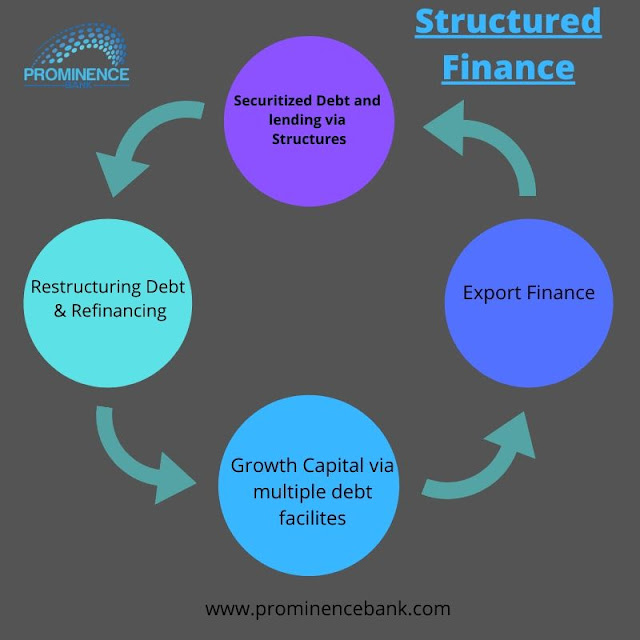

- Structured finance products is a financial instrument available to companies with complex financing needs, which cannot be ordinarily solved with conventional financing.

- Traditional lenders do not generally offer structured financing.

- Structured finance products are non-transferable

Structured finance products are an important arrangement which has to be given by the bank and also it plays an important role in promoting international import as well as export.

The bank issues structured finance products on the receipt that is to be requested by the applicant. This agreement accepted is of the amount that is to be issued by the bank to the beneficiary. In the case international bank guarantee there is one more party involved in the processing that a correspondent bank.

Structured finance products is a greatly involved in providing all the financial instrument presented to large financial institutions or companies with complicated financing needs unsatisfied with conventional financial products.

It is a kind of the important document that is to be issued under some term and condition and these term and condition has to be followed by everyone involved in the process. This structured finance products agreement acts as an undertaking and also this agreement assures the applicant as well as the beneficiary that the bank is liable to pay the specified amount to the applicant. The applicant might default in delivering the all the required statements to the bank as the part of the guarantee.

In effect, the BG acts as a promise that in case the liabilities of the applicant (bank’s customer) don’t meet, the bank shall meet the contractual liability. One must note that the obligation to pay is not of the applicant, but of the bank since the bank acts as the guarantor. BG contract is independent of the underlying transaction/contract that exists between the beneficiary and the applicant.

A structured finance products statement is one of the most important contributions towards the client as well as to the association to be on safer side. Structured financial products are almost always non-transferable, meaning that they cannot be shifted between various types of debt in the same way that a standard loan can.

.jpg)

Comments

Post a Comment